近日,复旦大学经济学院孙健教授接受中国国际电视台(CGTN)采访,就大宗商品投机问题发表看法。以下为采访全文:

作者简介 孙健,北京大学数学系毕业,芝加哥大学博士毕业,现为复旦大学经济学院教授。截止2016年3月份,在摩根士丹利固定收益部执行总经理,从事固定收益类,大宗商品类衍生品交易和风险对冲。此前任XE Capital对冲基金董事总经理,负责管理包括金融衍生工具在内的数十亿美元的金融资产。更此前,在法国巴黎国民银行(BNP Paribas)对冲基金结构产品部任总经理,负责交易对冲基金类结构性衍生品和结构性投资,和其他公司成员管理160亿美元的对冲基金资产。

主要工作领域:金融衍生品(股票,利率、大宗商品类 )、结构性金融产品、对冲基金交易和管理、结构性融资、高频交易统计套利等。

Speculations in commodities raise concerns

China's National Development and Reform Commission is talking to China’s futures brokerages to investigate potential speculations in the commodities futures market.

Trading volume of commodities futures has been rising this year, supported by a jump in raw material prices, for example iron ore, which had risen by around 20% in the past two months.

'Definitely, there are some fundamentals behind it. We have some global and domestic demand for infrastructure,' said David Nealis, president of the financial firm, Ceres.

But fundamentals only explain part of the picture. “Generally, it’s speculators coming into the market that are creating artificial pricing.”

Speculations in commodities futures are raising concerns from officials. Late last month, the vice president of the China Securities Regulatory Commission, Fang Xinghai, said during a press conference that the futures market does not need such an artificially high volume of trading.

Experts say one source of speculation comes from investors who were previously speculating in the real estate market, but who were deterred by local governments’ recent home purchase restrictions.

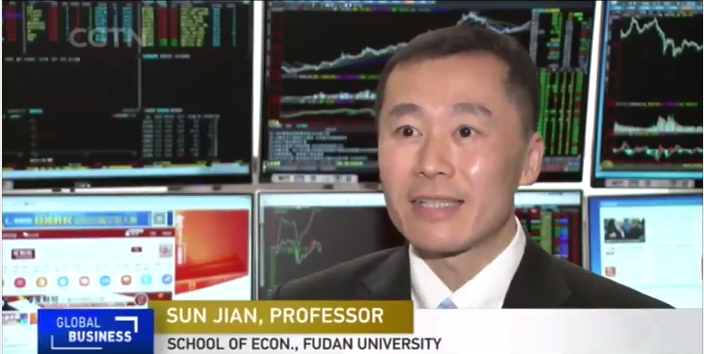

The speculators are coming from more than one source as well. Sun Jian, professor of Fudan University, said, “I knew a lot of professional traders that actually diverged a lot of money from the stock market, as well as from the stock futures market to the commodities market.”

And there’s a bigger problem. The National Development and Reform Commission has recently begun to look into such speculations, as many are worried that the bubble in commodities might eventually affect general prices in the economy.

'At the end of 2016, until most recently, both CPI and PPI increased a lot, and I think there’s a direct consequence of increase in the commodities raw material prices', said Sun.

Analysts say if this trend continues, the regulators would be almost certain to take action. 'We will definitely see increased fees for trading and maybe they’re gonna put some parameters on the trades as well. You know, limiting the amount of access to the market,' said Nealis.

During the Two Sessions top Chinese officials vowed to continue deleveraging the economy. Economists believe with pressures on prices rising, financial markets in China could expect a tighter policy environment in 2017.

文章来源:CGTN

点击阅读原文查看完整视频采访

返回顶部

返回顶部