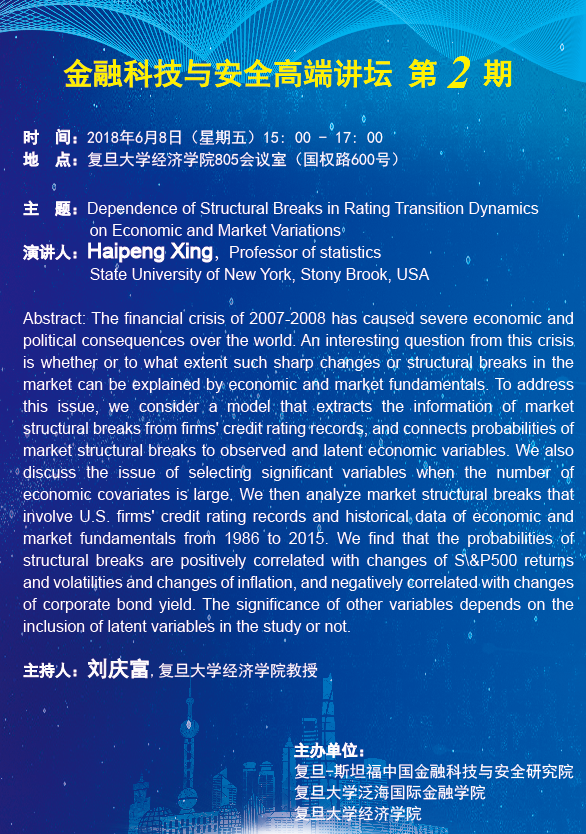

金融科技与安全高端讲坛第2期:Dependence of Structural Breaks in Rating Transition Dynamics on Economic and Market Variations

题目:Dependence of Structural Breaks in Rating Transition Dynamics on Economic and Market Variations

时间:2018年6月8日(星期五)15:00—17:00

地点:复旦大学经济学院805会议室(国权路600号)

Abstract: The financial crisis of 2007-2008 has caused severe economic and political consequences over the world. An interesting question from this crisis is whether or to what extent such sharp changes or structural breaks in the market can be explained by economic and market fundamentals. To address this issue, we consider a model that extracts the information of market structural breaks from firms' credit rating records, and connects probabilities of market structural breaks to observed and latent economic variables. We also discuss the issue of selecting significant variables when the number of economic covariates is large. We then analyze market structural breaks that involve U.S. firms' credit rating records and historical data of economic and market fundamentals from 1986 to 2015. We find that the probabilities of structural breaks are positively correlated with changes of S\&P500 returns and volatilities and changes of inflation, and negatively correlated with changes of corporate bond yield. The significance of other variables depends on the inclusion of latent variables in the study or not.

主讲人:

Haipeng Xing

Professor of statistics

State University of New York, Stony Brook, USA.

Prof. Xing graduated from Stanford’s statistics department with a doctorate in 2005. He taught at Columbia’s statistics department for two years and then moved to Stony Brook University in 2008. He also served as a consultant for the office of Chief Economist and Vice President at the World Bank during May 2010-June 2011. His research focuses on (i) change-points detection, parameter estimation and adaptive control problems and their applications in engineering, economics and genetics; (ii) statistical models and methods in financial econometrics and engineering; and (iii) time series modeling. His work includes papers published in the Annals of Applied Statistics, Statistica Sinica, Journal of American Statistical Association, Sequential Analysis, and Journal of Banking and Finance. He is co-author, with T.L. Lai of Stanford, of two major textbooks on financial statistics and risk management.

返回顶部

返回顶部