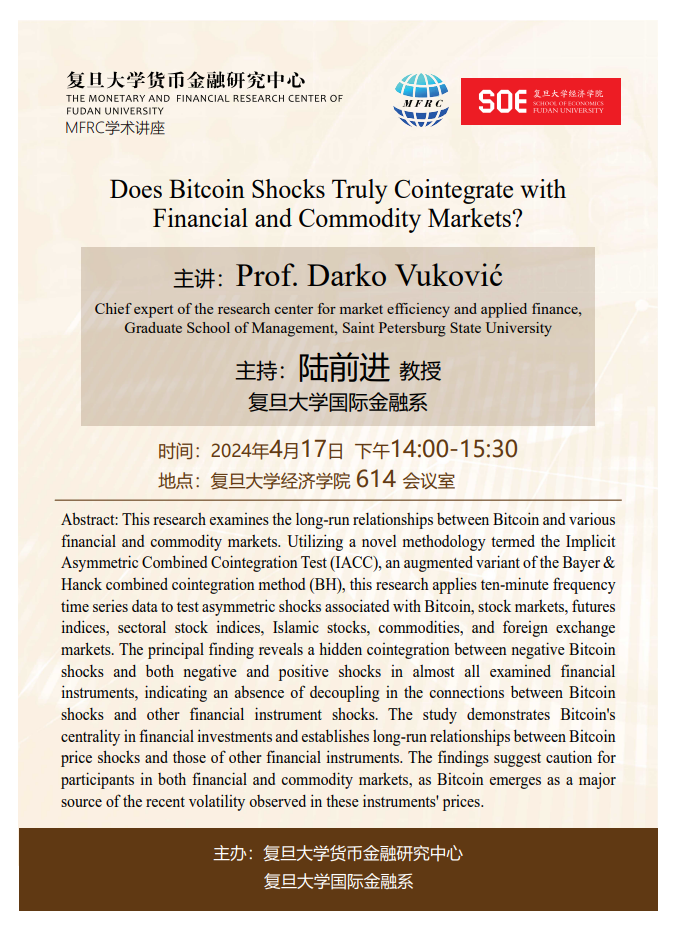

主题:Does Bitcoin Shocks Truly Cointegrate with Financial and Commodity Markets?

主讲:Prof. Darko Vuković

Chief expert of the research center for market efficiency and applied finance,

Graduate School of Management, Saint Petersburg State University

主持:陆前进 教授 复旦大学国际金融

时间:2024年4月17日下午14:00-15:30

地点:复旦大学经济学院614会议室

主办:复旦大学货币金融研究中心/复旦大学国际金融系

Abstract: This research examines the long-run relationships between Bitcoin and various financial and commodity markets. Utilizing a novel methodology termed the Implicit Asymmetric Combined Cointegration Test (IACC), an augmented variant of the Bayer & Hanck combined cointegration method (BH), this research applies ten-minute frequency time series data to test asymmetric shocks associated with Bitcoin, stock markets, futures indices, sectoral stock indices, Islamic stocks, commodities, and foreign exchange markets. The principal finding reveals a hidden cointegration between negative Bitcoin shocks and both negative and positive shocks in almost all examined financial instruments, indicating an absence of decoupling in the connections between Bitcoin shocks and other financial instrument shocks. The study demonstrates Bitcoin's centrality in financial investments and establishes long-run relationships between Bitcoin price shocks and those of other financial instruments. The findings suggest caution for participants in both financial and commodity markets, as Bitcoin emerges as a major source of the recent volatility observed in these instruments' prices.

返回顶部

返回顶部